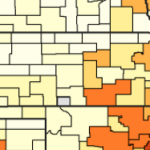

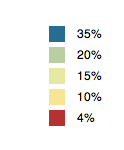

Result of a new national study shows there is over a 15% chance a child in Northwest Kansas will go from bottom 5th income to top 5th in their lifetime.

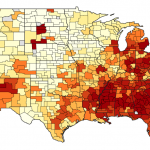

Enabling children to rise out of poverty is a primary goal of policies such as the Earned Income Tax Credit (EITC), the Child Tax Credit, and other tax expenditures. Building on previous research on the EITC, they studied the impact of tax expenditures on intergenerational mobility. They found substantial variation in the economic outcomes of children from poor families across areas of the United States. These differences are modestly correlated with variation in tax expenditure policies across areas, but much variation in children’s success across areas remains to be explained.

This project was funded by the National Science Foundation, the Lab for Economic Applications and Policy (LEAP) at Harvard, the Center for Equitable Growth at Berkeley, and the John and Laura Arnold Foundation.