WASHINGTON (AP) — The Latest on the tax overhaul from House Republicans (all times local):

11:25 a.m.

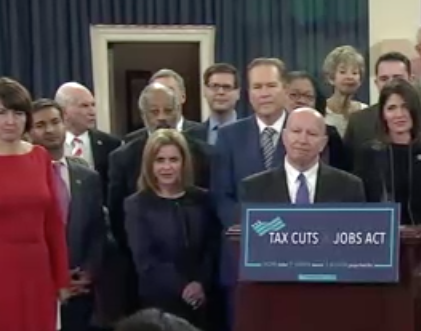

House Republicans have released their tax cut plan — and it would slash the corporate tax rate, lowers taxes for most people and limit a cherished deduction for homeowners.

President Donald Trump and the GOP are trying to deliver on the first tax revamp in three decades.

The proposal would add $1.5 trillion to the nation’s debt over the next decade.

Middle-income families would pay less thanks to doubling of the standard deduction and an increase in the child tax credit.

The wealthy would benefit from the repeal of the alternative minimum tax and a phase out of the estate tax.

Some two-income, upper middle class families would pay more after being bumped into a higher tax bracket and losing a valuable deduction on state income taxes.

___

10:30 a.m.

The House GOP tax plan would require some upper-income taxpayers to pay a higher top rate under a new rate structure.

The result would be to increase the tax burden on those subject to a lower rate under the current system.

Families earning more than $260,000 now have a top rate of 33 percent. They’d get kicked up to the 35 percent bracket. At present, the 35 percent rate starts at $416,700 for married couples.

High-bracket earners, especially in high-tax states, would lose the benefit of deducting state income taxes.

But middle-class earners would benefit. That’s because the bill would nearly double the standard deduction to $24,000 for couples and an increase in the per-child tax credit from $1,000 to $1,600.

And the child credit would be available to households earning up to $230,000, more than double the current income limit. A $300 credit would apply to each parent and nonchild dependent.

___

9:45 a.m.

House Republicans are proposing to place new limits on the tax deduction for mortgage interest in their soon-to-be-released overhaul.

A summary of the plan says it would reduce the cap on the popular deduction to interest on mortgages of $500,000 for newly purchased homes. The current mortgage cap is $1 million.

The idea is sure to generate opposition from the real estate lobby, but it’s being used to help pay for tax cuts elsewhere in the plan.

The plan also limits the deductibility of local property taxes to $10,000 while eliminating the deduction for state income taxes.

The child tax credit would rise from $1,000 to $1,600, though the $4,050 per child exemption would be repealed.

___

WASHINGTON (AP) — House Republicans are set to unveil their far-reaching tax overhaul Thursday. They are making major changes while looking to preserve current tax rules for retirement accounts popular with middle-class Americans and retain a top income-tax rate for million-dollar earners.

GOP negotiators scrambled this week to finalize details of the first major revamp of the tax system in three decades. Though working furiously, they missed a self-imposed Wednesday deadline as top Republicans batted down rumors that the public rollout could be delayed until next week.

The legislation is a longstanding goal for Capitol Hill Republicans who see a once-in-a-generation opportunity to clean up an inefficient, loophole-cluttered tax code.