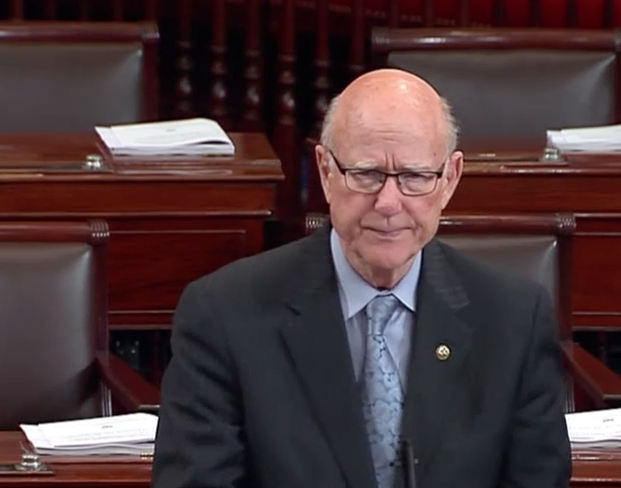

WASHINGTON, DC – U.S. Senator Pat Roberts legislation to prohibit the Internal Revenue Service (IRS) from threatening the privacy and security of charitable donors’ personal information was approved by the Senate Finance Committee. The legislation passed as an amendment to the Taxpayer Protection Act of 2016.

WASHINGTON, DC – U.S. Senator Pat Roberts legislation to prohibit the Internal Revenue Service (IRS) from threatening the privacy and security of charitable donors’ personal information was approved by the Senate Finance Committee. The legislation passed as an amendment to the Taxpayer Protection Act of 2016.

“Last year the IRS proposed an unnecessary and burdensome rule that threatened the security of charitable donors’ private information and would have had a chilling effect on charitable donations,” Roberts said. “Luckily they scrapped the plan, and my amendment will prohibit the IRS from simply recycling this short-sided plan and proposing a similar rule in the future.”

The attempt by the IRS to change charitable donation reporting rules began in September of 2015, when the IRS proposed a rule calling on charitable organizations to ask for additional personal donor information including the name, address, Social Security or tax identification number of any donor making a contribution of $250.00 or more. Under current law, the responsibility to substantiate the contribution is on the donor. Most non-profits provide that information to the donors for their record-keeping.

Roberts first introduced a stand-alone bill to block this rule in December 2015. To view his speech on the Senate floor about the bill, click here.