The 2017 Kansas Legislative Session began on Monday, January 9 with the swearing in of all members. More than a third of the Kansas House will be new this year, as we welcomed an incoming class of 46 new members. Five of that group, however, have previous experience as House members and are now returning. The majority party Republicans number eighty-five and are joined by forty Democrats. The legislature is scheduled to reach first adjournment on April 7. Veto session will convene on May 1, and the theoretical 90th day end of the session will come on Mothers Day, May 14. Although many pundits are predicting a long and contentious legislative session which could stretch well into June, the House got out of the gates rapidly this week and passed its first piece of legislation on day four of the session. That is nearly unprecedented, and is evidence of the resolve on the part of both leadership and members to get about our business quickly and responsibly. Governors State of the State Address Governor Brownback delivered the annual State of the State address on Tuesday afternoon in the House Chambers. The governor reiterated his belief in the effectiveness of the income tax break given to small businesses in 2012. He voiced continued opposition to Medicaid expansion, especially in light of current federal movement to repeal Obamacare. The speech introduced some intriguing proposals, including a new dental school at the University of Kansas Medical Center, locating a private school of osteopathic medicine in Kansas, and challenging Kansas universities to offer a four-year degree for a total tuition cost of $15,000. While each proposal would bring great benefit to the people of Kansas, few details were provided, leaving some to wonder how realistic the proposals might be. Governors Budget Report On Wednesday Shawn Sullivan, Director of the Budget, released the governors budget report. It contained proposals to close the projected $340 million shortfall for fiscal year 2017 (ending on June 30) as well as proposals to deal with a $580 million projected shortfall in fiscal year 2018. Highlights: FY 2017 (ending June 30):

FY 2018 and 2019:

Governors Tax Proposal:

Cumulatively, these tax proposals would produce $179 million in 2018 and $199 million in 2019 The solutions the governor proposes have been characterized as very unpalatable by many observers. But more than anything that is a reflection of the dire fiscal circumstances the state currently faces. There is room for disagreement over how we got to this point and why. However, there is no controversy over the stark fact that the state is now broke, and that the practice of cobbling together annual budgets with unreliable and one-time funding sources cannot continue. In the short run, our list of potential solutions is short and it will be a process of ranking a variety of undesirable options in order to find the best possible approach. Whatever the legislature settles on for a solution, it too is likely to be quite unpalatable. Longer term, the people of Kansas are asking for and deserve a long-term structural solution to the current fiscal imbalance. Finding that solution will require resolve, persistence, and cooperation on the part of all legislators. First Bill of the Year Passes the House On Thursday the House considered and passed an elections bill brought to the body by the Elections Committee and its Chairman Keith Esau. With the likely confirmation of 4th District Congressman Mike Pompeo as the new Director of the CIA, a special election will be necessary to pick his replacement in Congress. Inconsistencies in Kansas election law raise the prospect that the election results could later be challenged. The bill removes those inconsistencies and will allow for an orderly selection of Pompeos replacement. It is expected the bill will be quickly approved by the Senate and with the Governors signature the new law will be in place before the resignation of Congressman Pompeo. Pay-Go On Thursday the House adopted new House Rules which will guide the legislative process for the next two years. A key amendment was to revise the pay-go rule. Pay-go is shorthand for pay as you go, a concept which first appeared in federal budget debates. At the federal level the pay-go rule meant that a member of Congress could not propose an amendment requiring spending which would increase the national debt. Deficit spending is not an option at the state level, but in 2011 the Kansas House adopted a version of pay-go allowing members to amend an appropriations bill only in a manner which would not increase the overall spending authorized by the bill. Pay-go has been controversial since its first adoption. There is an appreciation for the strong fiscal responsibility it represents, but many members believe it concentrates too much power in the hands of those on the appropriations committee. They point out that only eleven members of the House (a majority of the membership on appropriations) can effectively control proposed expenditures with very limited input from the general membership. This is sometimes viewed as a disenfranchisement of the members not involved, and denial of their right to effectively represent their constituents in appropriations deliberations. Though there is merit to that argument, the concept of pay-go is essentially moot at a time when the states finances are in disarray. Thursday the rules committee proposed an amendment to the pay-go rule which would eliminate pay-go if and when state finances improve to the point that the state general fund contains a 7.5% ending balance, as currently required by law but frequently violated in recent years. The rule was adopted after extensive debate, and strikes a balance between the desire for full inclusion, debate and amendment and the need for strong fiscal discipline, especially in difficult financial times. Pay-go is much more restrictive if appropriations bills are brought to the floor in piecemeal fashion. Although appropriations bills are typically quite broad, and address most or all state general fund expenditures, there have been instances in recent sessions when appropriations bills have been brought forward which only concern certain departments or agencies. That severely constricts the ability of members to identify sources of funding to address their particular concerns. The willingness of the members to adopt a revised version of pay-go for 2016 can be viewed as display of trust that House leadership will allow broad appropriations bills to be considered. Lawrence Journal-World editorial: Pay-Go helps fiscal discipline Can Government be Run Like a Business? The debate about what is the proper domain of government and where the dividing line should be between business and government is a discussion which traces back to the very founding of our country. The topic is once again of interest as the nation prepares for the inauguration of President-elect Donald J. Trump, a business tycoon with no prior government experience. This article from Knowledge@Wharton, an electronic service of Wharton School of Business at University of Pennsylvania, examines the question in depth: Can Government be Run Like a Business WIBW Radio Appearance My first 2017 appearance on WIBW Radio came in the early morning hours of Thursday, January 12. Due to the retirement of my friend Rep. Tom Moxley, this year my partner in the monthly radio interviews is Rep. Larry Hibbard (Toronto). Larry did a great job in his first performance. Give it a listen: WIBW Ag Issues 1-12-2017 Cowboy Logic No one gives advice with more enthusiasm than the uninformed. Quote of the day “The most important thing in communication is to hear what isn’t being said.” – Peter Drucker Sermon in a sentence If you hold your tongue, you cant be misquoted. |

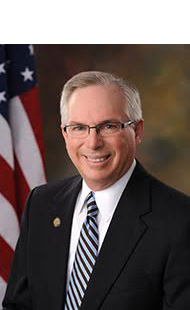

HINEMAN: A new legislative session begins