By BECKY KISER

Hays Post

An informational hearing was held in the Kansas legislature this week regarding the new federal tax bill and its effect on the state.

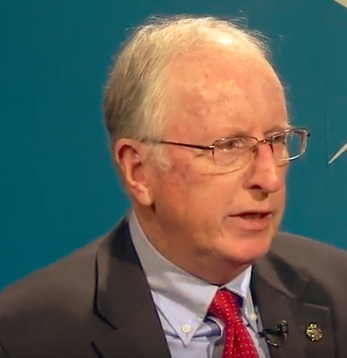

Many Kansans pre-filed their 2017 taxes because there is no tax advantage for individuals to wait until 2018, and that gave the state a huge increase over last year, according to Rep. Eber Phelps of Hays (D-111th Dist.). Corporate filings however, were down because many Kansas corporations will file in 2018 for federal tax breaks available this year for businesses.

“The report indicated Kansas would likely see an increase of about $138 million when the fiscal year starts July 1st, and an additional $180 million the following year,” Phelps said.

Phelps later talked to staff in the Legislative Research Department who said they are still trying to “sort it out.” The department provides nonpartisan, objective research and fiscal analysis for the Kansas Legislature.

“We’re not sure where our money is going to be and it’s making it very difficult in the Appropriations Committee to determine what kind of budget we’re going to put together. The Tax Committee is also looking at this very closely,” added Phelps.

“I expect a clearer picture towards the end of the session.”