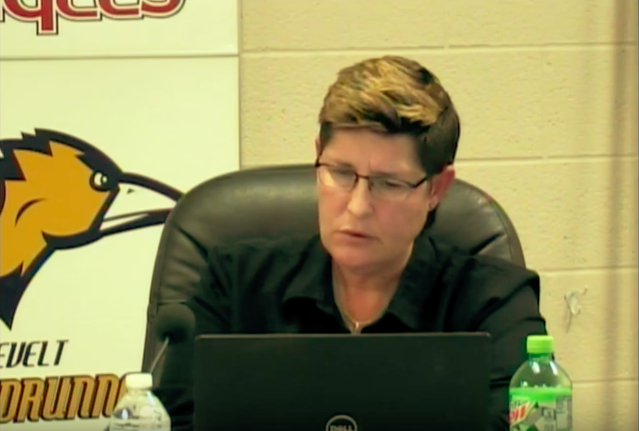

Age: 57

Education: BS Industrial Technology Education and Elementary Education, Masters in Education Administration

Do you have a student currently attending USD 489 schools?

Yes, my son is a junior at Hays High School.

Qualifications? 35 years in education and served USD 489 for 31 years. Worked as a paraprofessional, K-12 teacher, coach, migrant director, transition coordinator, and 25 years of that was the elementary principal.

Do you support USD 489 trying for another bond issue? What do you think that bond should include? If you don’t support a bond issue, how do you think the school district should address its infrastructure needs?

The next board will need to use all avenues including a bond issue to raise funds to provide the necessary improvements needed to meet the current and future needs of the district. If a bond issue is to be attempted again, much work in involving and informing our community in all stages will be necessary. Our district needs to repair trust in our community. It must start in action steps that our community can see.

All K-12 levels need improvement in facilities, but our K-5 schools have been the most affected by recent board decisions. Their environment needs to be addressed soon. I was part of two successful bond elections in USD 489 and that experience could help in this process.

Our district needs to be creative. In past years teachers and administrators were encouraged and supported to help with facilities through substantial grants and donations. That culture has diminished and has not been encouraged or realized as often in our K-12 levels in recent years.

In the meantime, we cannot not wait for a bond issue. The past decade we have heard the board say we need a 10-year plan and no plan is available. A systematic approach of preserving the resources we have and building for the future needs to start now.

What would you do to secure the financial health of the school district?

My plan would be to work collaboratively together with the other board members to review all budgetary items as presented by the administration. Upon the review ask questions and make suggestions when appropriate.

The Hays school board is at impasse with its teachers for the second year in a row. What would you do to improve relations with teachers?

It is unusual for school boards and teachers not agreeing on a contract two years in a row. Positive communication and a willingness to negotiate is necessary from both sides of the table. This process takes a commitment to invest many hours and allow the process to work.

Fair and equitable pay and fostering a culture of teamwork and respect for the work that teachers do would go a long way toward improved morale. If teachers have confidence and trust in the board, employees have less stress and higher energy for their daily tasks. Quality teachers and other employees are recruited and retained by competitive salaries and benefits.

Do you support the district’s current one-to-one technology policy? If not, what would you propose?

It is important to continue to provide the latest technology for our students and staff. By the time we purchase equipment it is often one or two years behind. We cannot afford to miss an update. Because technology is ever-changing, we need to provide inservice that is appropriate and valuable to the staff. Staff and administration spend many hours evaluating the latest technology that is appropriate for what they need. We need to listen and act accordingly.

How would you support the district in its work to improve student performance?

Research shows that one of the best ways to ensure students’ performance is an experienced and qualified teacher. We need to support all staff members and provide the tools they need to perform the task we ask them to do. Another way the board can help, is to be familiar with and show a strong support of (KESA) the Kansas plan for district improvement and provide inservice and time for teachers to implement the changes. The board plays a major role in creating a culture that fosters a positive learning and working environment.

Is there anything else you would like to add about you or your campaign?

“Kids and Families First” is the belief I will refer to on all decisions if I have the honor to serve on the USD 489 school board. My experience as an educator at all levels is to ask the question, “Is it best for kids?” If the answer is yes, correct decisions will follow.

Our district has a long history of being leaders in the state and on the cutting edge of new trends and practices. We are now seeing many changes and opportunities to advance our district and provide all our students with the best education possible. I want to be part of that movement, and together we can make a difference.

RELATED STORY: USD 489 election: Park seeks to build trust, involvement